MALAYSIA'S NATURAL RUBBER OUTPUT DROPS 20.9% IN APRIL -- DOSM

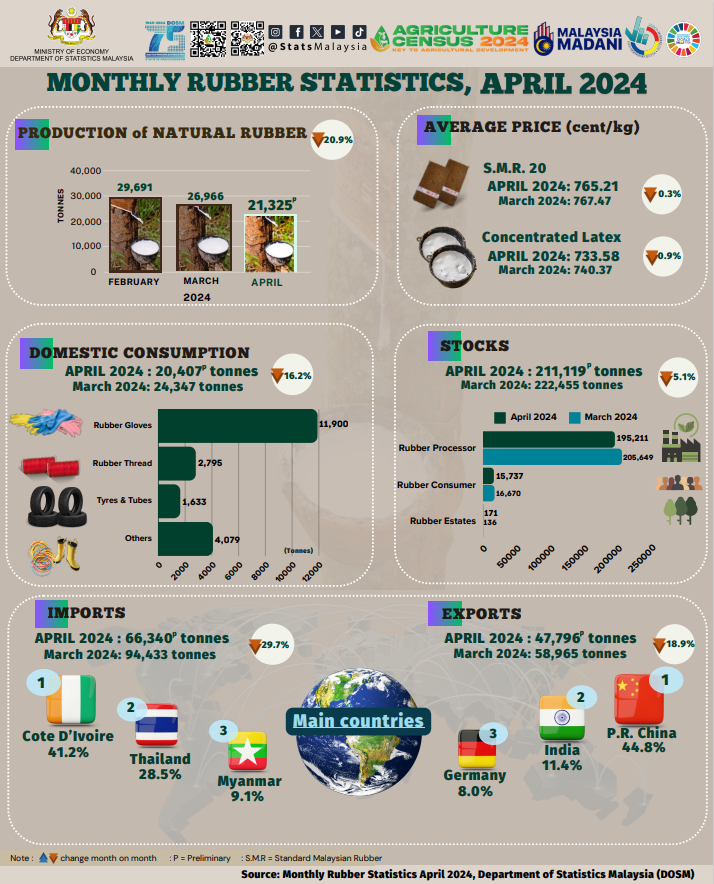

Malaysia's natural rubber (NR) production fell by 20.9% to 21,325 tonnes in April 2024 from 26,966 tonnes in March of this year, according to the Department of Statistics Malaysia (DoSM).

Year-on-year, NR production decreased by 9.1% to 23,460 tonnes in April 2023, it said in a statement.

Chief statistician Datuk Seri Dr Mohd Uzir Mahidin stated that smallholders contributed 89.1% of NR production in April this year, with the estates sector accounting for the remaining 10.9%.

In terms of inventory, total NR stocks declined by 5.1% to 211,119 tonnes from 222,455 tonnes in March 2024.

Rubber processing factories held 92.4% of the stocks, followed by rubber consumer factories (7.5%) and rubber estates (0.1%).

Mohd Uzir noted that Malaysia's NR exports amounted to 47,796 tonnes in April 2024, marking an 18.9% decrease from March 2024's 58,965 tonnes.

China remained the main destination for NR exports, accounting for 44.8% of total exports in April 2024, followed by India (11.4%), Germany (8.0%), the United Arab Emirates (4.3%) and Pakistan (3.9%).

“The export performance was contributed by NR-based products such as gloves, tyres, tubes and rubber thread,” he said.

Gloves were the primary exports among rubber-based products, with a value of RM1.09 billion in April 2024, marking a 3.8% decrease from RM1.14 billion in March 2024.

According to DoSM, the average monthly price analysis showed that concentrated latex decreased by 0.9% in April 2024 to 733.58 sen per kilogramme (kg), while scrap rubber slipped by 0.1% to 639.62 sen per kg.

“Prices for all Standard Malaysian Rubber (SMR) decreased between 0.3% to 0.9%,” it said.

Meanwhile, the Malaysian Rubber Board Digest in April 2024 reported a mixed trend in the Kuala Lumpur rubber market, with SMR 20 initially showing an upward movement before easing towards the end of the month.

“The natural rubber market declined due to adverse weather conditions in major producing countries.

“However, the market sentiment received support from encouraging Chinese economic data, continuous support measures from China, a weaker ringgit against the US dollar, and a steady economic growth forecast by the International Monetary Fund (IMF),” it added.