MIDF SEES HIGHER INFLATION THIS YEAR AFTER APRIL PPI SIGNALS RISING COST PRESSURES

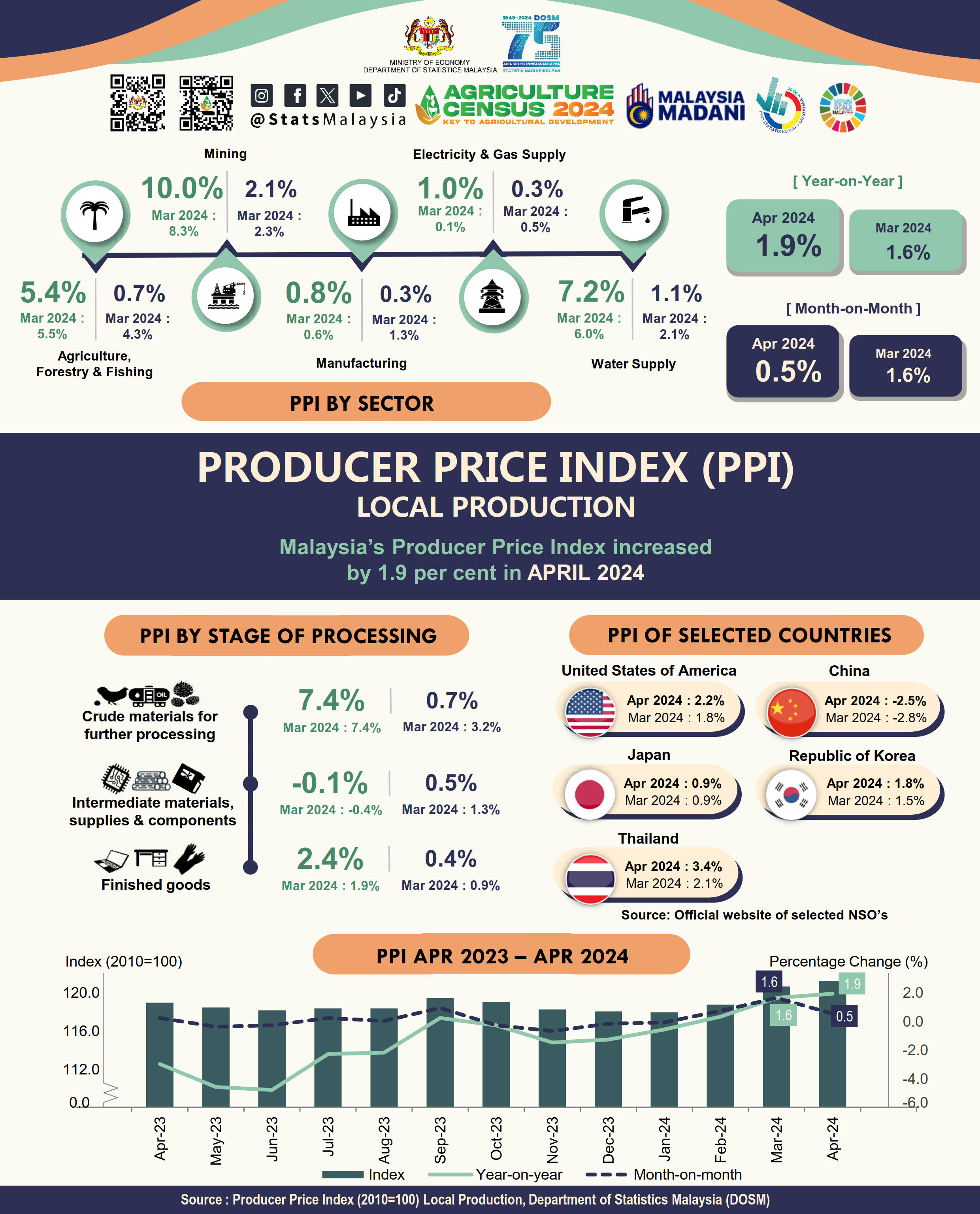

The rising Producer Price Index (PPI) inflation of 1.9% year-on-year (y-o-y) in April 2024 signalled higher cost pressures for local businesses, said MIDF Research.

It said that although businesses would be affected by the fluctuations in global commodity prices, cost pressures would be higher this year due to the effects of policy changes such as subsidy rationalisation as well as rising fuel prices.

"On that note, we foresee that consumer inflation would be slightly higher at 2.7% this year (2023: 2.5%), mainly due to supply-side changes," said the research firm in a report.

Malaysia's PPI for April 2024 rose for the third straight month in the fastest increase since December 2022.

MIDF noted that by sector, the manufacturing sector saw input costs rising faster at 0.8% y-o-y (March 2024: 0.6% y-o-y). The mining sector's inflation was higher at 10.0% (March 2024: 8.3% yoy), the steepest rise in 22 months. However, price inflation for the agriculture sector eased slightly to 5.4% (Mar 2024: 5.5%).

The costs for electricity, gas and water supply expanded faster by 1.0%, the highest in 10 months after a slow rise of 0.1% yoy in the previous two months.

"By the production stage, the cost of processing crude materials rose at the same pace of 7.4% as in the previous month, which is still the highest reading since June 2022.

“Cost for processing intermediate materials deflated further but marginally at 0.1% (March 2024: -0.4% yoy), the softest deflation in a year," it said.

The processing cost of finished goods surged by 2.4% (March 2024: 1.9%), the steepest in seven months.