Malaysia's economic growth to slow significantly in 2023, says Fitch Solutions

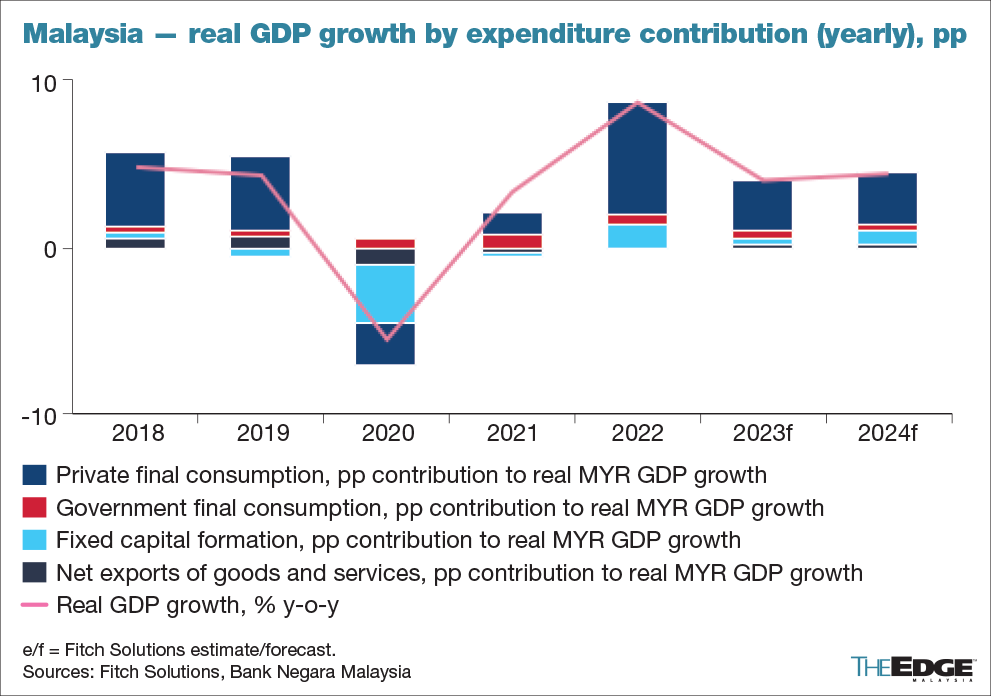

Fitch Solutions Country Risk and Industry Research has maintained its forecast for Malaysia’s real gross domestic product (GDP) growth to slow to 4.0% in 2023, from 8.7% in 2022.

In a report on 13th February, the firm said the latest data showed that growth already slowed to 7.0% year-on-year (y-o-y) in the fourth quarter of 2022 (4Q2022), from 14.2% in the previous quarter, and the slowdown was broad-based.

Looking ahead, Fitch Solutions expects the fading of base effects and pent-up demand, tighter credit conditions, and a weakening global growth outlook to pose significant growth headwinds.

The firm said the Malaysian economy expanded by 7.0% y-o-y in 4Q2022 according to the latest national account data released on 17th February, slowing significantly from the growth rate of 14.2% in 3Q2022.

“The growth print came in above the consensus and our expectations, and brought the full-year growth rate to 8.7% in 2022, versus our estimate of 8.4%.

“On a seasonally adjusted basis, however, output contracted by 2.6% quarter-on-quarter (q-o-q). While we expect the economy to return to growth over the coming quarters [on a q-o-q basis], we believe that the pace of economic expansion will moderate significantly going forward, as credit conditions tighten further and pent-up demand fades,” it said.

Fitch Solutions said that moreover, the export outlook will likely weaken further on the back of a slowing global economy, and as the semiconductor industry continues to be in a downcycle.

“Accordingly, at Fitch Solutions, we maintain our forecast for Malaysia’s real GDP growth to come in at 4.0% in 2023.

“From a GDP by expenditure perspective, the growth slowdown in 4Q2022 was broad-based, with export growth weakening the most from 23.9% y-o-y in 3Q2022, to 9.6% in 4Q2022.

“Meanwhile, private consumption growth also slowed to 7.4% y-o-y, versus 15.1% in the previous quarter, while gross fixed investment expanded by 8.8% y-o-y, compared with 13.1% in 3Q2022,” it said.

Risks to outlook

Fitch Solutions said risks to its real GDP growth forecast are balanced.

It said on the upside, if the Russia-Ukraine war escalates and sanctions against Russia are tightened, this could lead to upside commodity price volatility and exacerbate the global shortage of key commodities, such as oil and palm oil, of which Malaysia is a net exporter.

It said that on the downside, a global recession would lead to further slowdown in trade activity, and with exports accounting for close to 74% of Malaysia’s GDP, this would have an adverse impact on headline growth.