Upbeat outlook on O&G sector

Industry observers and analysts are of the general opinion that 2023 could be a bright year for the oil and gas (O&G) industry, by and large mirroring the outlook that local integrated O&G titan Petroliam Nasional Bhd (PETRONAS) has cast on the prospects of the sector as well as its own.

行业观察家和分析师普遍认为,2023 年对石油和天然气 (O&G) 行业来说可能是光明的一年,这在很大程度上反映了当地综合 O&G 巨头 Petroliam Nasional Bhd (PETRONAS) 对石油和天然气 (O&G) 行业的展望该行业及其自身的前景。

Aside from the optimism by PETRONAS, experts said their hopeful outlook on the sector is also underpinned by factors including oil prices remaining elevated at current levels, the expected recovery in investment spending and improved activity levels from oil majors for next year, as well as undemanding valuations and buying opportunities throughout the O&G space.

除了 PETRONAS 的乐观态度外,专家们表示,他们对该行业充满希望的前景还受到以下因素的支撑,包括油价在当前水平保持高位、投资支出的预期复苏和明年石油巨头的活动水平提高,以及需求不高整个 O&G 领域的估值和购买机会。

Kenanga Investment Bank (KIB) Research said it is positive overall on the sector heading into next year, despite PETRONAS’ own warning that uncertainties in the energy market are expected to persist.

Kenanga Investment Bank (KIB) Research 表示,尽管 PETRONAS 自己警告能源市场的不确定性预计将持续存在,但该行业进入明年总体上是积极的。

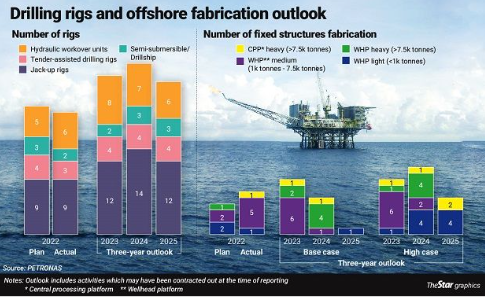

With PETRONAS mentioning it is expecting to utilise 26 drilling rigs in 2023, as the number of jack-up rigs is anticipated to increase from nine units to 12 and hydraulic work units (HWU) predicted to also rise to eight units from the present six, KIB Research analyst Steven Chan expects jack-up rig providers Velesto Energy Bhd and Uzma Bhd who also operates the HWU space – to benefit.

PETRONAS 提到预计到 2023 年将使用 26 台钻井平台,因为自升式钻井平台的数量预计将从 9 台增加到 12 台,液压工作装置 (HWU) 预计也将从目前的 6 台增加到 8 台, KIB Research 分析师 Steven Chan 预计自升式钻井平台供应商 Velesto Energy Bhd 和 Uzma Bhd(也经营 HWU 空间)将从中受益。

The research outfit said Dayang Enterprise Holdings Bhd the biggest player in the hook-up and commissioning (HUC) as well as offshore maintenance, construction and modification (MCM) segments, should also be a big beneficiary of the expected O&G crest next year.

该研究机构表示,Dayang Enterprise Holdings Bhd 是连接和调试(HUC)以及海上维护、建造和改造(MCM)领域的最大参与者,也应该是明年预期的 O&G 顶峰的一大受益者。

“This is because PETRONAS is expecting to see a jump to five million man-hours in 2023 from only 3.4 million this year for the HUC segment.

“这是因为PETRONAS预计 HUC 部门的工时将从今年的 340 万增加到 2023 年的 500 万。

“For the MCM segment, PETRONAS anticipates to see the number of man-hours jump to 11.9 million in 2023, from 8.7 million in 2022,” noted Chan in his report.

Chan 在他的报告中指出:“对于 MCM 部分,PETRONAS 预计工时数将从 2022 年的 870 万增加到 2023 年的 1190 万。”

Separately, sharing KIB Research’s upbeat sentiment on the O&G sector, Hong Leong Investment Bank (HLIB) Research went as far to say it believes 2023 would be a “golden year” for O&G service providers.

另外,丰隆投资银行 (HLIB) 研究部分享了 KIB Research 对 O&G 行业的乐观情绪,甚至表示相信 2023 年将是 O&G 服务提供商的“黄金年”。

However, it did caution that supply and demand dynamics for oil could maintain parity over the first few months of next year, leading to more sideways movement in oil price for the first half of 2023 (1H23).

但是,它确实警告说,石油的供需动态可能会在明年的前几个月保持平价,从而导致 2023 年上半年 (1H23) 的油价出现更多横向波动。

HLIB Research analyst Jeremy Goh said: “Based on our research on publications from multiple organisations such as the International Energy Agency, the Energy Information Administration (EIA) and Organisation of Petroleum Exporting Countries (Opec), we expect global oil demand and supply to be at parity around 100 million to 102 million barrels per day (bpd) in 1H23.

HLIB Research 分析师 Jeremy Goh 表示:“根据我们对国际能源署、能源信息署 (EIA) 和石油输出国组织 (Opec) 等多个组织的出版物的研究,我们预计全球石油需求和供应将1H23 的平价产量约为每天 1 亿至 1.02 亿桶 (bpd)。

“However, we highlight that global crude oil demand could see upside possibility with China’s highly likely reopening in 2023. The EIA forecasts global oil inventories to fall by 200,000 bpd in 1H23 before rising by almost 700,000 bpd in 2H23.”

“然而,我们强调,随着中国极有可能在 2023 年重新开放,全球原油需求可能会出现上行趋势。EIA 预测全球石油库存将在 1H23 下降 200,000 桶/日,然后在 2H23 上升近 700,000 桶/日。”

While there remains a number of factors that could lend to a continued increase in demand for oil in 2023, including lower production by Opec and its allies and the gradual relaxation of China’s zero-Covid policies, the research house predicts that oil would hover around the relatively lower range of US$85 to US$90 (RM377 to RM399) per barrel throughout the year, due to a weak macroeconomic environment and ample supply.

尽管仍有许多因素可能导致 2023 年石油需求持续增长,包括Opec及其盟友的减产以及中国零疫情政策的逐步放松,但该研究机构预测,油价将徘徊在由于宏观经济环境疲软和供应充足,全年每桶 85 美元至 90 美元(377 令吉至 399 令吉)的范围相对较低。

HLIB Research nonetheless noted that recent oil consumption data have surprised to the upside, which was especially apparent in non-Organisation for Economic Cooperation and Development regions, including China, India and the Middle East.

尽管如此,HLIB Research 指出,最近的石油消费数据出人意料地上升,这在非经济合作与发展组织地区尤其明显,包括中国、印度和中东。

Companies-wise, the research unit echoed the views of KIB Research, forecasting companies such as Dayang, Velesto, Icon Offshore and Perdana Petroleum to do well, while at the same time also seeing a bullish 2023 for Petra Energy Bhd and Carimin Petroleum Bhd in the HUC and MCM segments.

公司方面,该研究部门回应了 KIB Research 的观点,预测 Dayang、Velesto、Icon Offshore 和 Perdana Petroleum 等公司表现良好,同时也看到 Petra Energy Bhd 和 Carimin Petroleum Bhd 在 2023 年的前景看好HUC 和 MCM 部分。

HLIB Research, though, sang a more cautionary tune of the petrochemical segment, noting the fact that product spreads having come off their respective peaks as a signal that the petrochemical “super cycle” has passed.

不过,HLIB Research 对石化板块持更谨慎的态度,指出产品价差已经脱离各自的峰值,这是石化“超级周期”已经过去的信号。

“Spreads are lifting off their peaks due to additional new supply globally and the normalising of short-term supply shortage, on top of limited demand growth amid high commodity prices worldwide, coupled with stagflation risks,” its analyst Goh said.

其分析师 Goh 表示:“由于全球新增供应增加,短期供应短缺正常化,再加上全球大宗商品价格高企导致需求增长有限,再加上滞胀风险,价差正从高位回落。”

He added that investors should stay off downstream petrochemical names amid the likely outcome of a petrochemical bear cycle in 2023.

他补充说,鉴于 2023 年石化熊市周期的可能结果,投资者应远离下游石化名称。

Both research houses believe things should also look up for PETRONAS itself, with its capital expenditure (capex) being kept around the RM50bil mark in 2023, on healthy activity levels.

两家研究机构都认为,马石油本身的情况也应该有所好转,其资本支出(capex)在 2023 年保持在 500 亿令吉左右,处于健康的活动水平。

KIB Research said PETRONAS should have little problems fulfilling its capex and dividend commitments with a strong net cash position of RM103bil.

KIB Research 表示,凭借 1030 亿令吉的强劲净现金状况,PETRONAS 在履行其资本支出和股息承诺方面应该没有什么问题。

Meanwhile, although acknowledging that macroeconomic challenges such as broadening inflationary pressures, labour shortages and supply chain disruptions have yet to recede, PETRONAS said 2022 has seen the industry rebound strongly as oil prices reached its highest level against crude oil benchmark prices.

与此同时,虽然承认通胀压力扩大、劳动力短缺和供应链中断等宏观经济挑战尚未消退,但马石油表示,随着油价相对于原油基准价格达到最高水平,2022 年该行业将强劲反弹。

“The race by governments worldwide to reopen their economies as well as the removal of travel restrictions have contributed to a surge in demand despite the challenging economic landscape,” it said in its Activity Outlook 2023-2025 report, adding that it would continue to invest in business activities and growth projects.

它在其《2023-2025年活动展望》报告中表示:“尽管经济形势充满挑战,但世界各国政府竞相重新开放经济,以及取消旅行限制,导致需求激增。”该公司还表示,将继续投资于商业活动和增长项目。