Possible recession, diminished low base effect to moderate corporate earnings growth in 2023

After a turbulent year of war, skyrocketing inflation, aggressive rate hikes, with labour shortage seen in many sectors, including the worst pandemic-hit hospitality sector, it is only to be expected that investors will be wary of what 2023 may bring.

经过动荡的一年战争、飙升的通货膨胀、激进的加息,许多行业都出现劳动力短缺,包括受疫情影响最严重的酒店业,投资者只能预期将警惕 2023 年可能带来的影响。

An analyst The Edge spoke to opined that while there will continue to be general recovery in Malaysia’s economy — with China’s reopening expected to help sustain that — macro challenges relating to the very likely scenario of a recession in the US, moderating commodity prices, and moderating leading index in Malaysia could weigh heavily on both corporate earnings quality and investors’ position in the equity market this year.

The Edge接受采访的分析师认为,虽然马来西亚经济将继续普遍复苏——中国的重新开放预计将有助于维持这种复苏——但宏观挑战与美国很可能出现衰退、商品价格放缓和经济放缓有关。马来西亚的领先指数可能会对今年的企业盈利质量和投资者在股市中的地位产生重大影响。

Building recession-resistant equities portfolios will be crucial this year, said James Cheo, chief investment officer for Southeast Asia, global private banking and wealth at HSBC.

汇丰银行东南亚、全球私人银行和财富首席投资官 James Cheo 表示,今年建立抗衰退的股票投资组合将至关重要。

“History has taught us that sharp falls tend to be followed by good returns in the following year — on average about 8% for bonds and 20% for stocks. That should give investors some courage to put cash to work. And it’s obvious that following the sharp correction of 2022, valuations are more attractive and that should improve long-term expected returns,” Cheo said.

“历史告诉我们,大幅下跌往往伴随着次年的良好回报——债券平均约为 8%,股票平均约为 20%。这应该会给投资者一些勇气,让他们投入现金。很明显,在 2022 年大幅调整之后,估值更具吸引力,这应该会提高长期预期回报,”Cheo 说。

However, as public listed companies will have exhausted the low base growth effect in the last earnings quarter of 2022, core earnings are expected to be tested in 2023, said Areca Capital chief executive officer Danny Wong.

然而,Areca Capital 首席执行官 Danny Wong 表示,由于上市公司将在 2022 年最后一个财报季度耗尽低基数增长效应,核心盈利预计将在 2023 年受到考验。

“Input costs have been rising across the board in almost all sectors, particularly in terms of labour and raw materials. These substantially increase operating costs for companies this year. We have already seen this happening last year, and this will continue into 2023,” said Wong.

“几乎所有行业的投入成本都在全面上升,尤其是在劳动力和原材料方面。这些都大大增加了公司今年的运营成本。去年我们已经看到这种情况发生,并且这将持续到 2023 年,”Wong 说。

The Edge takes a look at some of the sectors that are expected to thrive versus those that will be more challenging in 2023.

The Edge审视了一些有望在 2023 年蓬勃发展的行业与那些将更具挑战性的行业。

Banking sector expected to benefit from another potential OPR hike

银行业有望从另一次潜在的 OPR 上调中受益

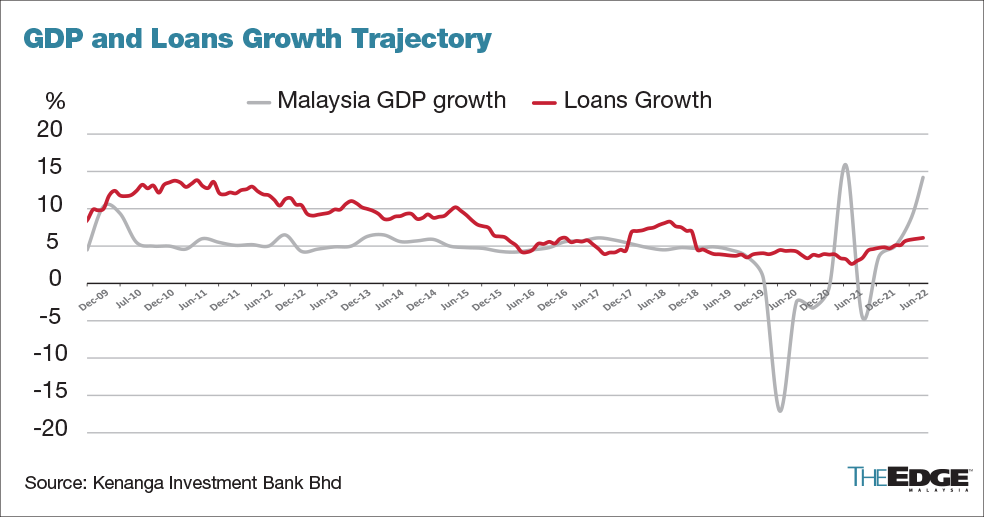

In March last year, the US Federal Reserve began a series of interest rate hikes. Its aggressive monetary policy tightening set into motion a cycle of rate hikes by central banks all over the world, including Bank Negara Malaysia (BNM). After four consecutive hikes of 25 basis points (bps), BNM raised the overnight policy rate (OPR) to 2.75% from its record low of 1.75%.

去年3月,美联储开始了一系列的加息行动。其激进的货币政策紧缩启动了包括马来西亚国家银行(BNM)在内的世界各地中央银行的加息周期。在连续四次加息 25 个基点 (bps) 后,国行将隔夜政策利率 (OPR) 从历史低点 1.75% 上调至 2.75%。

Although clearly bad news for borrowers, the banking sector has historically benefited from the higher interest rate, said Fortress Capital Asset Management Sdn Bhd CEO Thomas Yong.

Fortress Capital Asset Management Sdn Bhd 首席执行官 Thomas Yong 表示,虽然对借款人来说显然是个坏消息,但银行业历来受益于更高的利率。

“On a year-on-year basis, the banks' core profits are likely to improve, underpinned by higher net interest margins in line with higher interest rates. Earnings growth could accelerate to 15% to 20% for 2023 in the absence of 'Cukai Makmur'. This could potentially allow the banks to pay out higher dividends,” Yong told The Edge.

“与去年同期相比,银行的核心利润可能会有所改善,这得益于更高的净息差和更高的利率。在没有“Cukai Makmur”的情况下,2023 年的盈利增长可能会加速至 15% 至 20%。这可能会让银行支付更高的股息,”Yong 告诉The Edge。

While BNM bucked the consensus estimate of another OPR increase by keeping the key rate unchanged at its first Monetary Policy Committee (MPC) meeting of the year on 19th January, many economists do not think this signifies the end of its tightening cycle, as core inflation remains elevated at an average of 3% in 2022.

尽管国行在 1 月 19 日举行的今年第一次货币政策委员会(MPC)会议上维持关键利率不变,从而打破了对另一次 OPR 上调的普遍预期,但许多经济学家认为这并不意味着其紧缩周期的结束,因为核心通胀到 2022 年仍保持平均 3% 的增长。

Fitch Solutions said while core inflation remains on a firm uptrend, headline inflation is expected to stay above the central bank’s target through the first half of the year, especially with negative real interest rates. "We believe that above-target inflation and negative real interest rates will prompt further tightening by the central bank to safeguard macroeconomic stability,” the firm said in a statement.

Fitch解决方案表示,虽然核心通胀仍处于稳固的上升趋势,但总体通胀预计将在今年上半年保持在央行的目标之上,尤其是在实际利率为负的情况下。该公司在一份声明中表示:“我们认为,高于目标的通胀和负实际利率将促使央行进一步收紧货币以维护宏观经济稳定。”

“Core inflation hit 3% for 2022, the highest ever recorded. We opine the strong inflation trend in Malaysia is highly driven by solid consumer demand while indicators for cost inflation are on a slowing pace... With this upbeat momentum, we believe BNM may consider to raise the OPR by another 25bps to 3% in the second MPC meeting in March 2023," it said in a report on January 20th following the release of December inflation data.

“2022 年核心通胀率达到 3%,创历史新高。我们认为马来西亚强劲的通胀趋势很大程度上是由稳固的消费者需求驱动的,而成本通胀指标正在放缓......鉴于这种乐观的势头,我们认为国行可能会考虑在明年将 OPR 再提高 25 个基点至 3%第二次 MPC 会议将于 2023 年 3 月举行,”它在 1 月 20 日发布的 12 月通胀数据发布后的一份报告中表示。

Although BNM unexpectedly took a prudent pause on its interest rate hike on 19th January, the central bank has guided that it is not done with the interest rate hikes yet and future rate move remains data dependent, noted UOB Global Economics and Markets Research in a separate report on 20th January.

大华银行全球经济与市场研究部在另一份报告中指出,尽管国行在 1 月 19 日出人意料地暂停了加息,但央行已指导加息尚未结束,未来的利率走势仍取决于数据1月20日报道。

While it is also of the view that recent global developments and country-specific factors suggest rising challenges for BNM to hike further in the near term, it still expects BNM to make at least one more 25bps hike to bring the OPR back to its pre-pandemic 3% by mid-2023, before taking a long pause for the rest of the year.

尽管该行也认为,最近的全球事态发展和各国具体因素表明,国行在近期进一步加息的挑战越来越大,但该行仍预计,国行至少将再加息一次25个基点,以便在2023年中期之前将OPR恢复到疫情前的3%,然后在今年剩余时间里长时间暂停加息。

Headwinds dissipating for construction, with rollout of more public projects

随着更多公共项目的推出,建筑业的逆风正在消散

Contractors will benefit from the rollout of public infrastructure projects, spearheaded by the massive RM50.2 billion circle metro line MRT3 project, as the new government gets down to work, said Kenanga Research in a note on 16th December, 2022.

Kenanga Research 在 2022 年 12 月 16 日的一份报告中表示,随着新政府开始工作,承包商将受益于公共基础设施项目的推出,这些项目由耗资 502 亿令吉的大型地铁 MRT3 环线项目牵头。

“We expect the new government to re-tender selective public infrastructure projects and roll out new ones, after completing reviews on certain previous job awards that were deemed not in compliance with the required procurement process,” said its analyst Joshua Ng.

其分析师 Joshua Ng 表示:“我们预计新政府在完成对某些先前被认为不符合所需采购流程的工作奖励的审查后,将重新招标选择性公共基础设施项目并推出新项目。”

There are also opportunities in the private space where there are growing opportunities in building new semiconductor plants and data centres locally as multinational corporations diversify their manufacturing bases geographically to de-risk, Ng said.

Ng 说,随着跨国公司在地理上分散其制造基地以降低风险,私人领域也有越来越多的机会在当地建造新的半导体工厂和数据中心。

“We expect industry margins to improve in 2023 as older contracts with low margins tail off and new contracts with more normalised margins start to contribute,” he added.

“我们预计行业利润率将在 2023 年提高,因为低利润率的旧合同逐渐减少,而利润率更加正常化的新合同开始有所贡献,”他补充道。

Plantation to remain flat on weather anomalies, worker shortage

种植园因天气异常、工人短缺而保持平稳

Crude palm oil prices are expected to stay elevated at an average at RM3,800 per metric ton in 2023 on the back of acknowledging palm oil as a basic consumable needed for day-to-day living, and resumption of normalised growth in the 2023 edible oil market after staying flattish since 2020, said Kenanga Research.

Kenanga Research表示,由于人们承认棕榈油是日常生活所需的基本消费品,以及2023年食用油市场在自2020年以来保持平稳后恢复正常增长,粗棕榈油价格预计将在2023年保持平均每公吨3800令吉的高位。

The research outfit added that palm oil output is also expected to grow despite labour shortages constraining Malaysia’s output to levels achieved in 2021.

该研究机构补充说,尽管劳动力短缺将马来西亚的产量限制在 2021 年达到的水平,但预计棕榈油产量也将增长。

“In 2023 global demand is also likely to pick up at comparable pace as the net supply-demand scenario looks quite even handed for 2023 and potentially, for 2024 as well,” said Kenanga.

Kenanga 说:“到 2023 年,全球需求也可能以可比的速度回升,因为 2023 年的净供需情况看起来相当平衡,2024 年也可能如此” 。

However, higher operating cost from labour, fertiliser and transportation costs was a key reason for the poorer-than-expected recent third quarter of 2022 (3Q2022) results across the plantation sector.

然而,劳动力、化肥和运输成本带来的更高运营成本是整个种植业 2022 年第三季度 (3Q2022) 业绩差于预期的主要原因。

“As such, higher productivity is key to ensure unit production cost remains competitive, hence the push to replant with higher yielding planting materials, mechanisation will add value to downstream,” noted the research firm.

“因此,更高的生产力是确保单位生产成本保持竞争力的关键,因此推动使用更高产的种植材料进行补种,机械化将为下游增加价值,”该研究公司指出。

Mixed year for property as higher interest rates, borrowings add to woes

由于更高的利率,借贷加剧了困境,房地产的好坏参半

Light on the property sector will be dim this year as the reopening effect fades with economic growth expected to slow in 2023, according to Maybank Investment Bank Research.

根据 Maybank Investment Bank Research 的数据,随着重新开放的影响逐渐消退,预计 2023 年经济增长将放缓,今年房地产行业的前景将黯淡。

“Some developers have planned a slowdown of new launches or lowered sales target for 2023 given uncertainties on labour supply and property demand with higher interest rate,” said Maybank's Winson Phoon in a note on 6th January.

马来亚银行的 Winson Phoon 在 1 月 6 日的一份报告中表示:“鉴于劳动力供应和房地产需求的不确定性以及更高的利率,一些开发商计划放缓新推出或降低 2023 年的销售目标。”

Kenanga Research, likewise, expects the operating environment for developers to remain challenging, with unfavourable industry trends that cloud 2022 persisting into 2023.

同样,Kenanga Research 预计开发人员的运营环境仍将充满挑战,2022 年的不利行业趋势将持续到 2023 年。

“These include soft prices, as reflected in a weak house price index as reflected by a quarter-on-quarter contraction in 3QCY2022 despite rising construction and land costs, and the still-elevated household debt-to-GDP ratio at 85% in 1HY2022,” said Kenanga's analyst Lum Joe Shen.

“其中包括疲软的价格,这反映在尽管建筑和土地成本上涨,但 2022 年第 3 季度的环比收缩反映出疲软的房价指数,以及 2022 年第 1 季度家庭债务占 GDP 的比率仍然高达 85% ,”Kenanga 的分析师 Lum Joe Shen 说。

The firm also cautioned about developers’ high borrowing levels going into 2023, which would translate to higher financing costs and a potential liquidity crunch.

该公司还对开发商在 2023 年的高借贷水平提出警告,这将转化为更高的融资成本和潜在的流动性紧缩。

“Already faced with a tough operating climate, developers’ earnings will be hurt further by the high financial leverage. Developers under our coverage have all shown increased net debt levels over the pandemic with the exception of a few,” Lum added.

“已经面临艰难的经营环境,高财务杠杆将进一步损害开发商的收入。我们覆盖范围内的开发商都表现出在大流行期间增加了净债务水平,只有少数例外,”Lum 补充道。

Demand downcycle seen continuing for semiconductor players

半导体厂商的需求下行周期仍在继续

The semiconductor and technology sector should continue to see slower growth in earnings as demand from advanced economies slows.

随着发达经济体的需求放缓,半导体和科技行业的收益增长应该会继续放缓。

“We expect the semiconductor cycle to likely bottom out in the first half of 2023 before investor interest picks up again as the circular trend of technology demand persists,” said Fortress' Yong.

“我们预计半导体周期可能会在 2023 年上半年触底,然后随着技术需求的循环趋势持续存在,投资者的兴趣将再次回升,”Fortress 的 Yong 表示。

World Semiconductor Trade Statistics, in a November 2022 report, changed its forecast for global semiconductor demand growth in 2023 to a contraction of 4.1%, from its earlier forecast of a 4.6% expansion.

世界半导体贸易统计,在一份 2022 年 11 月的报告中,将其对 2023 年全球半导体需求增长的预测从之前预测的增长 4.6% 更改为收缩 4.1%。

US smartphone maker Apple has also warned of longer-than-expected delivery time for its latest smartphone model which would likely dampen companies' earnings in this sector, said Kenanga’s Samuel Tan in a research note.

Kenanga 的 Samuel Tan 在一份研究报告中表示,美国智能手机制造商苹果公司也警告说,其最新款智能手机的交付时间比预期的要长,这可能会抑制公司在该行业的收益。

“The recovery of global semiconductor demand will hinge on China, given its commanding market share. However, with no clear signs on how the country can fully extricate itself from the pandemic, supply chain challenges are expected to remain going into 2023,” said Tan.

“鉴于中国占据主导地位,全球半导体需求的复苏将取决于中国。然而,由于没有明确迹象表明该国如何才能完全摆脱大流行,供应链挑战预计将持续到 2023 年,”Tan 说。