Malaysia’s Trade Surplus To Continue Supporting Growth Despite Softening Exports, Says CGS-CIMB

The sizeable trade surplus will continue to support Malaysia’s growth this year despite expectations of softening exports in the months ahead, said CGS-CIMB Securities Sdn Bhd.

Economist Nazmi Idrus said the firm remains positive on Malaysia’s full-year trade balance outlook despite expectations of softening exports in the months ahead.

“A high base may continue to play a part in nominal trade performance, keeping export growth suppressed, alongside weak global demand.

“However, the trade surplus remains sizeable, and we believe this will continue to support our current account forecast of 2.1% of gross domestic product (GDP) for 2023 (2022: 2.6%),” he said in a note on 20th April.

Overall, CGS-CIMB maintained its 4.4% year-on-year (y-o-y) GDP growth forecast for 2023.

Kenanga Research said it foresees export growth to remain moderate in the coming months, with high probabilities of slipping into a contraction due to the normalisation of economic activities, relatively lower commodity prices, and the waning effect of the lower base recorded last year.

Against this backdrop, it keeps its first-quarter (1Q2023) GDP growth forecast unchanged at 5.1% (4Q2022: 7.0%), with full-year growth estimated at 4.7% (2022: 8.7%).

“Though the impact of the global economic slowdown is still uncertain, we still expect growth to be supported by China’s reopening.

“On the domestic front, growth is also expected to be supported by resilient domestic demand attributable to a lower unemployment rate, higher tourist arrivals and investments, as well as the resumption of infrastructure projects by the government,” it said.

Separately, AmBank Research said it expects slower trading activities going forward as guided by recent information flows.

“We expect the manufacturing purchasing managers’ index, which has been at the contractionary level since September 2022, to remain weak. Latest industrial production numbers, especially for the export-oriented segments, have also been trending lower over the same period”.

The research arm of AmBank Group projected the country’s economy to grow at 4.5% in 2023, mainly supported by domestic factors, including an improving labour market, investment realisation, and improvement in the construction and the agriculture sectors.

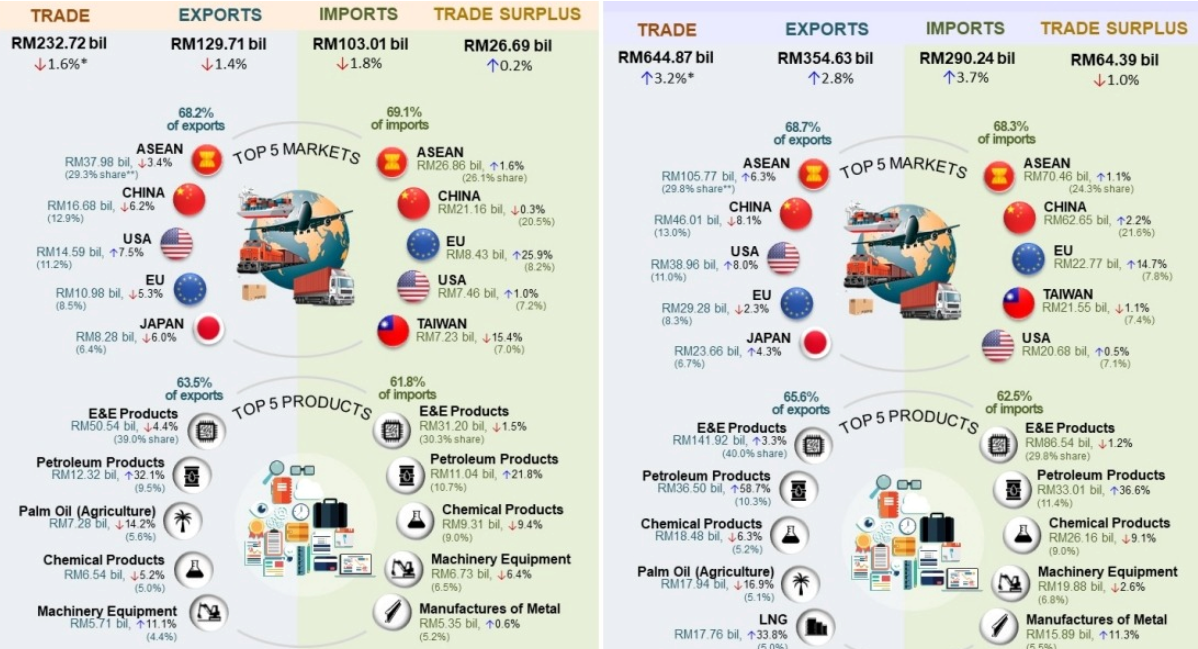

On 19th April, the Ministry of Investment, Trade and Industry revealed that Malaysia’s trade surplus widened y-o-y to RM26.69 billion in March 2023, marking the 35th consecutive month of trade surplus since May 2020, and the highest trade surplus ever recorded for March.

However, trade fell slightly by 1.6% to RM232.72 billion, while exports declined 1.4% to RM129.71 billion, and imports were lower by 1.8% y-o-y at RM103.01 billion.

Compared to February 2023, the ministry added that double-digit growth was recorded for trade (up 13.5%), exports (15.5%), imports (11.1%), and the trade surplus (36.4%).