Malaysian investors believe sustainable investing key to driving long-term returns: Study

A majority of Malaysian investors (62% versus 66% in Southeast Asia and 60% globally) are more likely to believe that investing sustainably is key to driving long-term returns, according to the Schroders Global Investor Study 2022.

根据Schroders 《2022年全球投资者研究》,大多数马来西亚投资者(62%, 东南亚为 66%,全球为60%)更有可能相信,可持续投资是推动长期回报的关键。

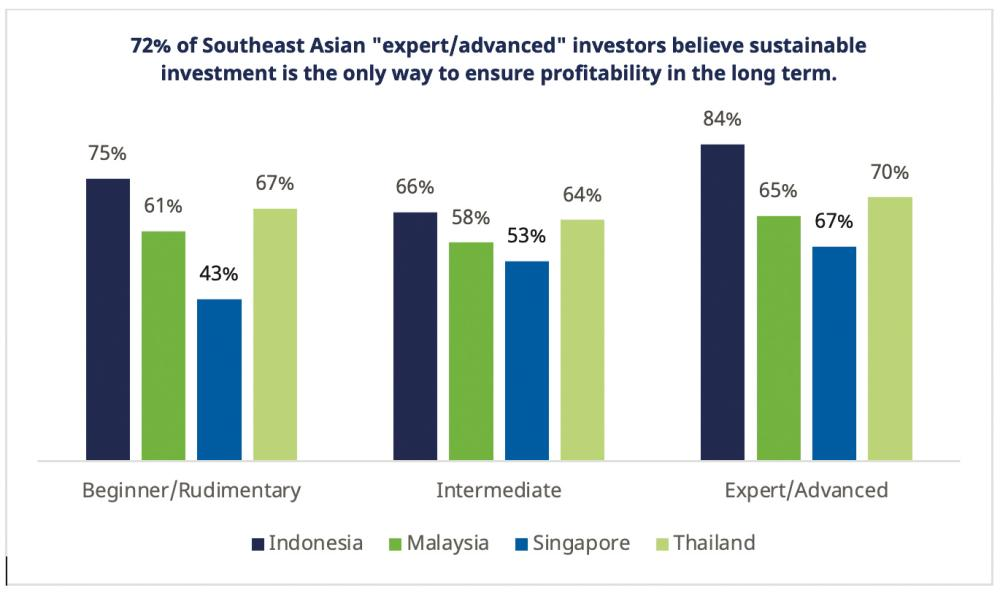

The sustainability-focused findings of Schroders’ flagship study, which has surveyed close to 24,000 people who invest from 33 locations globally, including Indonesia, Malaysia, Singapore and Thailand, found that more than two-thirds (65% versus 72% in Southeast Asia and 68% globally) of Malaysian investors who class themselves as having “expert/advanced” investment knowledge believe that sustainable investment is the only way to ensure profitability in the long term.

Schroders的主要研究以可持续发展为重点,调查了来自全球33个地区(包括印度尼西亚、马来西亚、新加坡和泰国)的近2.4万人。研究发现,在自认拥有“专家/先进”投资知识的马来西亚投资者中,超过三分之二(65%,东南亚为72%,全球为68%)认为可持续投资是确保长期盈利的唯一途径。

This compares with 58% of “intermediate” investors in Malaysia (versus 60% in Southeast Asia and 52% globally) and 61% of those who believe they have “beginner/rudimentary” investment knowledge (versus 62% in Southeast Asia and 43% globally).

相比之下,马来西亚58%的“中级”投资者(东南亚为60%,全球为52%)和61%的人认为自己拥有“初级/初级”投资知识(东南亚为62%,全球为43%)。

Similarly, 67% of “expert/advanced” investors (versus 72% in Southeast Asia and globally) share the view that investing sustainably can support positive change when it comes to challenges such as climate change.

同样,67%的“专家/高级”投资者(东南亚和全球72%的投资者)认为,在应对气候变化等挑战时,可持续投资可以支持积极的改变。

Specifically, the study found that environmental impact was the main reason people are attracted to sustainability investing (56% versus 58% in Southeast Asia and 52% globally). Financial gains came second at 49% (versus 37% in Southeast Asia and 36% globally), and societal principles ranked third in Malaysian investors’ list of priorities (41% versus 44% in Southeast Asia and 43% globally).

具体来说,该研究发现,环境影响是人们被可持续发展投资吸引的主要原因(56%,东南亚为58%,全球为52%)。 财务收益排名第二,为49%(东南亚为37%,全球为36%),社会原则在马来西亚投资者的优先考虑清单中排名第三(41%,东南亚为44%,全球为43%)。

However, a focus on delivering financial returns unsurprisingly still remains a priority for many investors.

然而,毫不奇怪,专注于提供财务回报仍然是许多投资者的首要任务。

More than half (65% versus 63% in Southeast Asia and 56% globally) seek a fund that focuses primarily on delivering financial returns while integrating sustainability factors. That is particularly the case for people in Asia (61%) and the Americas (60%), while people in Europe were more likely to choose a fund with sustainability characteristics (51%).

超过半数的投资者(65%,东南亚地区为63%,全球为56%)寻求的基金主要关注实现财务回报,同时考虑可持续性因素。 亚洲人(61%)和美洲人(60%)尤其如此,而欧洲人更倾向于选择具有可持续性特征的基金(51%)。

The study also found that people would increasingly invest in sustainable funds if they were able to invest in line with their preferences. More than half of Malaysian investors (58% versus 63% in Southeast Asia and 57% globally) across all self-defined expertise levels said that the ability to choose investments that align with their personal sustainability preferences would encourage them to increase their allocation to sustainable investments.

研究还发现,如果人们能够按照自己的偏好进行投资,他们会越来越多地投资可持续基金。 在所有自定义的专业水平中,超过一半的马来西亚投资者(58%,东南亚为63%,全球为57%)表示,选择符合个人可持续发展偏好的投资的能力将鼓励他们增加对可持续发展投资的配置。

In terms of investors’ specific sustainability goals, quality education was seen as the most important in Malaysia, with 20% of those surveyed (similar to 20% in Southeast Asia and globally) ranking this option first. Good health and wellbeing was also 20% (versus 17% in Southeast Asia and 12% globally), followed by no poverty (15% versus 15% in Southeast Asia and globally) and zero hunger (14% versus 13% in Southeast Asia and 14% globally).

在投资者的具体可持续发展目标方面,优质教育在马来西亚被视为最重要的,20%的受访者(类似于东南亚和全球的20%)将这一选项排在首位。 健康和福祉良好的比例也为20%(东南亚为17%,全球为12%),其次是无贫困(东南亚和全球为15%,15%)和零饥饿(东南亚为14%,13%,全球为14%)。

Apart from the ability to choose investments aligned with their personal sustainability preferences, around half (56% versus 51% in Southeast Asia and 48% globally) said that more education around sustainable investing would encourage them to allocate more sustainably. The lack of clear definitions of sustainable investments was cited as one of the most significant barriers to investing sustainably by all knowledge levels.

除了能够选择符合个人可持续性偏好的投资外,约半数受访者(56%,东南亚地区为51%,全球为48%)表示,更多关于可持续投资的教育将鼓励他们更可持续地进行配置。 缺乏对可持续投资的明确定义被认为是所有知识水平都无法进行可持续投资的最重要障碍之一。

Completing the top three, some 55% of Malaysian investors (versus 52% in Southeast Asia and 44% globally) stated that more data and evidence showing that investing sustainably delivers better returns would encourage them to increase their investments.

在前三名中,约 55% 的马来西亚投资者(东南亚为 52%,全球为 44%)表示,更多数据和证据表明,可持续投资可以带来更好的回报,这将鼓励他们增加投资。

Schroders Singapore CEO Lily Choh said a majority of investors in Malaysia believe sustainability is crucial to delivering long-term risk-adjusted returns.

Schroders新加坡首席执行官 Lily Choh 表示,马来西亚的大多数投资者认为,可持续性对于实现长期风险调整回报至关重要。

“The role that asset managers play is increasingly critical in helping investors differentiate and better understand the benefits of investing sustainably. The intrinsic link between long-term sustainable investment returns and investing in companies generating a positive impact on environmental and social causes is growing stronger each day.

“在帮助投资者区分和更好地理解可持续投资的好处方面,资产管理公司扮演的角色越来越重要。 长期可持续投资回报与投资于对环境和社会事业产生积极影响的公司之间的内在联系日益增强。

“Innovations in sustainable strategies to capture opportunities in the low-carbon transition and financial education are key to driving capital into sustainable investing. With a better understanding of the products they invest in and their impact on society and the environment, it would encourage them to increase their allocation to sustainable investment.”

“在低碳转型和金融教育中抓住机遇的可持续战略创新是推动资本进入可持续投资的关键。通过更好地了解他们投资的产品及其对社会和环境的影响,这将鼓励他们增加对可持续投资的分配。”