Malaysian economy set to moderate in 2023 but unlikely to tip into recession, Maybank IB says

Malaysia's economic growth is poised to moderate this year amid the lingering environment of high inflation and interest rates globally, but Maybank Investment Bank (Maybank IB) believes the country is unlikely to fall into a recession as local monetary policy remains non-restrictive, while softening of consumer spending cushioned by excess savings built up over the last two years。

在全球高通胀和高利率环境挥之不去的情况下,马来西亚今年的经济增长有望放缓,但马来亚银行投资银行(Maybank IB)认为,由于当地货币政策,该国不太可能陷入衰退仍然是非限制性的,同时过去两年积累的过剩储蓄缓冲了消费者支出的疲软。

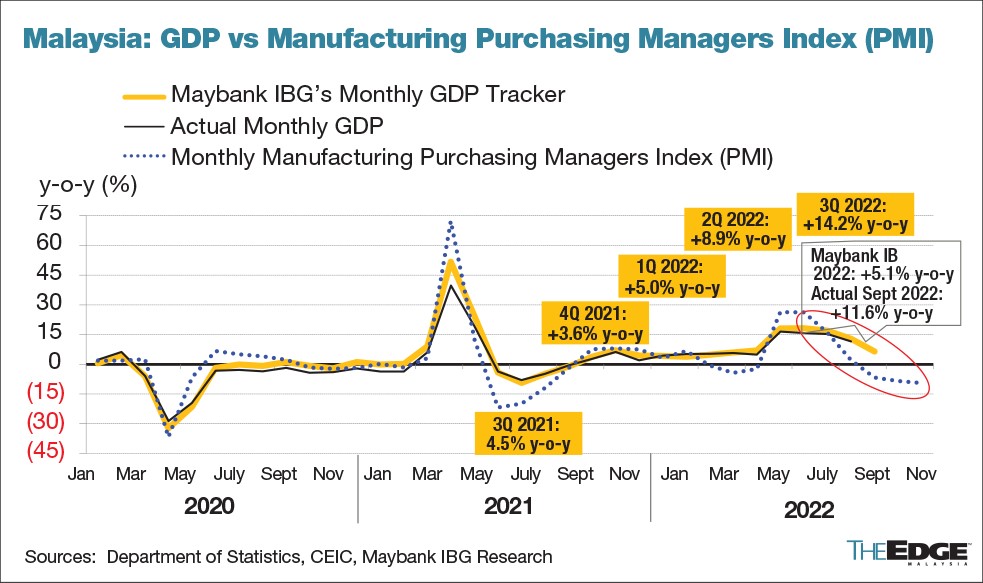

The investment bank is forecasting a 4% gross domestic product (GDP) growth for 2023, versus the estimated 8% growth last year.

该投资银行预测 2023 年国内生产总值 (GDP) 将增长 4%,而去年预计增长 8%。

Chief economist Suhaimi Ilias said although consumer spending growth is estimated to slow down to around 6% this year versus slightly above 11.5% in 2022, consumers are expected to tap into their excess savings built up during the pandemic years.

首席经济学家 Suhaimi Ilias 表示,尽管今年消费者支出增长预计将放缓至 6% 左右,而 2022 年将略高于 11.5%,但预计消费者将动用在大流行期间积累的过剩储蓄。

“Consumers have built up in excess savings since 2020, amidst lockdowns and economic stimulus measures, such as cash handouts, financial aids and of course the RM145 billion worth of pre-retirement EPF (Employees Provident Fund) withdrawal schemes, that has turned into drawdown of excess savings since May 2022, and this is providing buffer and support for consumer spending growth,” he explained during the Maybank IB 2023 Market Outlook media briefing on 5th January.

“自 2020 年以来,在封锁和经济刺激措施(例如现金发放、经济援助,当然还有价值 1450 亿令吉的退休前 EPF(雇员公积金)提款计划)的影响下,消费者积累了过多的储蓄,这已经变成了提款自 2022 年 5 月以来的过剩储蓄,这为消费者支出增长提供了缓冲和支持,”他在1 月 5 日的马来亚银行 IB 2023 市场展望媒体简报会上解释道。

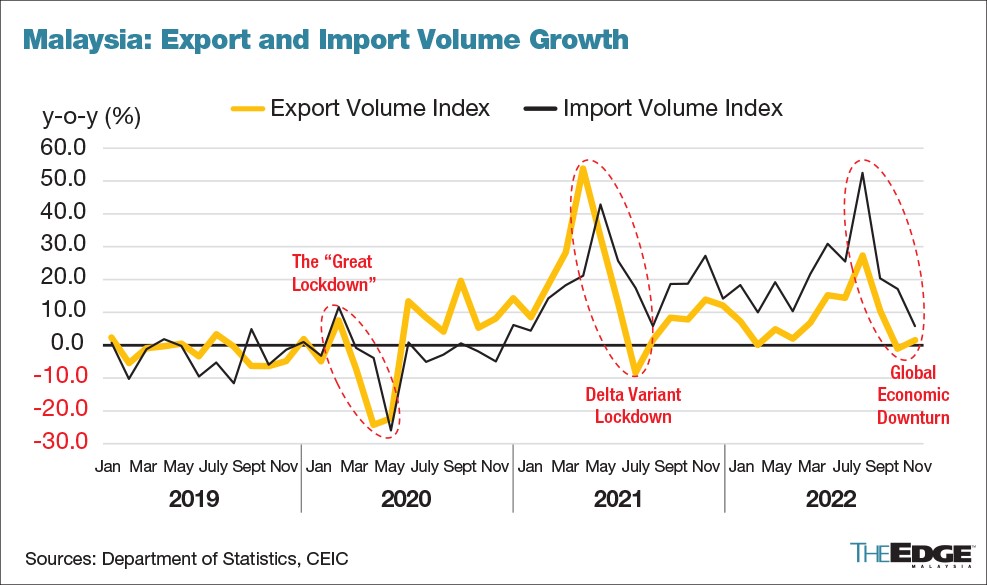

Additionally, inbound tourism is expected to sustain a reopening tailwind this year, while robust approved investment growth is likely to continue amid supply chain relocation and rising capital expenditure for data centres, 5G infrastructures as well as automation to address labour shortage issues, said Suhaimi.

此外,Suhaimi 表示,预计今年入境旅游业将保持重新开放的顺风,而随着供应链搬迁和数据中心、5G 基础设施以及解决劳动力短缺问题的自动化的资本支出增加,批准的投资增长可能会继续强劲。

“Before Covid-19, in 2019, tourism accounted for almost 12% of GDP, and we saw that as a result of pandemic and lockdown, closure of international borders, how tourism's contribution to the economy has drastically dropped to less than 4% of GDP on average in 2021 and 2020,” he said.

他说:“2019年2019冠状病毒病(Covid-19)之前,旅游业占GDP的近12%,我们看到,由于大流行和封锁,国际边界关闭,旅游业对经济的贡献在2021年和2020年大幅下降到平均不到GDP的4%。”

Nonetheless, Suhaimi said China will be a wildcard as with every one percentage point change in the world's second largest economy's GDP, Malaysia's growth will be affected by swinging 0.5 percentage point accordingly.

尽管如此,Suhaimi表示,中国将成为一个通配符,因为世界第二大经济体的国内生产总值每变化一个百分点,马来西亚的增长将相应受到 0.5 个百分点的影响。

“We expect China's growth to improve to 4% this year from our estimate of 3.3% last year, on the assumption of unwinding of zero-Covid policy there. This is short of the official figure of 5% growth.

“我们预计,在中国取消零冠政策的前提下,中国今年的经济增长将从去年的3.3%提高至4%。这低于5%的官方增长数字。

“Reason for this is we remain cautious especially in the real estate sector in China, which makes up 30% in GDP when you include various related activities in the value chain, and also account for a quarter of banking system loans,” he said.

“原因是我们仍然保持谨慎,尤其是在中国的房地产行业,如果将各种相关活动包括在价值链中,该行业占 GDP 的 30%,并且还占银行系统贷款的四分之一,” 他说。

“On the slump in property prices or default and trouble in repaying loans or coupon rate, there is a risk of a major ripple and systemic effect on China's economy, banks and markets if there is going to be a major meltdown in real estate, irrespective of the unwinding of zero-Covid policy. That's why China is a wildcard,” he added.

“关于房地产价格暴跌或违约以及偿还贷款或票面利率的困难,如果房地产出现重大崩盘,则有可能对中国经济、银行和市场产生重大连锁反应和系统性影响,无论零 Covid 政策是否解除。这就是为什么中国是一个通配符,” 他补充道。

Expects one more OPR hike amid elevated wage growth

预计在工资增长加快的情况下再次上调 OPR

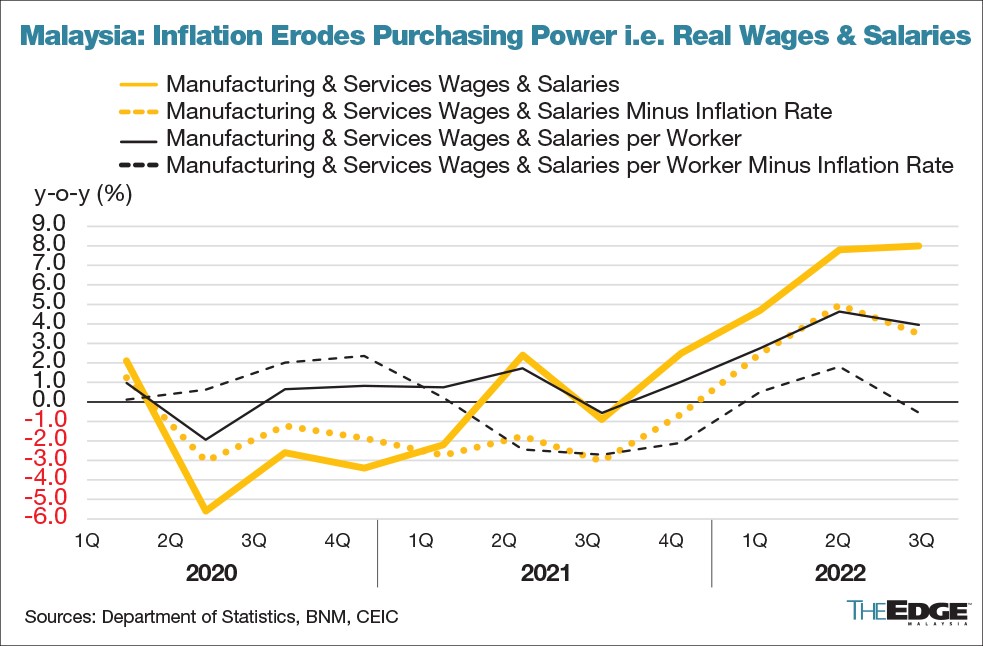

Given that the manufacturing and services sectors' wages and salaries growth remained elevated in the third quarter last year, Suhaimi is expecting Bank Negara Malaysia (BNM) to raise its overnight policy rate by another 25 basis points to 3% before pausing for the rest of this year.

鉴于去年第三季度制造业和服务业的工资和薪金增长仍然很高,Suhaimi 预计马来西亚国家银行(BNM)将隔夜政策利率再提高 25 个基点至 3%,然后在今年其余时间暂停。

“This basically means BNM's monetary policy is not restrictive as what we are seeing in major advanced economies, specifically the US. So, I guess that means BNM is trying to strike a balance in addressing inflation and supporting growth.

“这基本上意味着国行的货币政策并不像我们在主要发达经济体,特别是美国所看到的那样具有限制性。所以,我想这意味着国行正试图在应对通胀和支持增长之间取得平衡。

“I also take the view that recent improvements in the ringgit against the US dollar eases the pressure on BNM's interest rate policy,” he said.

“我还认为,最近令吉兑美元汇率的改善缓解了国行利率政策的压力,” 他说。

Suhaimi also pointed out that the ongoing high inflation has eroded consumers' purchasing power despite the high wage growth since the third quarter of 2021.

Suhaimi还指出,尽管自 2021 年第三季度以来工资增长很高,但持续的高通胀侵蚀了消费者的购买力。

Therefore, he said it is unlikely for the government to introduce Goods and Services Tax (GST) in the upcoming Budget 2023.

因此,他表示政府不太可能在即将到来的2023年财政预算案中引入商品及服务税(GST)。

“It is never popular to raise or introduce tax at a time when people are impacted by higher cost of living. In any case, any extra revenue needed for the government, to be honest, can come from non-tax revenue, and that basically boils down to Petronas dividend.

“在人们受到更高生活成本影响的时候,提高或引入税收从来都不受欢迎。无论如何,政府需要的任何额外收入,老实说,都可以来自非税收入,而这基本上归结为国油的股息。

“Since 2019, consistently every year the government has been getting a special dividend from Petronas anyway, above what was originally budgeted,” he noted.

“自 2019 年以来,政府每年都从国油那里获得特别股息,高于最初的预算,” 他指出。

Although crude oil price has come under pressure to US$80 level recently, Suhaimi said currently prices are still positive for Malaysia.

尽管原油价格最近受压至 80 美元水平,但Suhaimi表示,目前价格对大马仍然有利。

“In times of global downturn, or sharp slowdown or stagnation, crude oil price typically drop to around US$25-US$45 per barrel range. It is still around US$80 per barrel, so it is not currently behaving in a manner consistent with global downturn in the past,” he said.

“在全球经济低迷、急剧放缓或停滞时期,原油价格通常会跌至每桶 25 美元至 45 美元左右。它仍然在每桶 80 美元左右,因此目前的表现与过去全球经济低迷不一致,” 他说。

Budget 2023's subsidy measures to be a main focus

2023年预算的补贴措施将成为主要关注点

Suhaimi said another key focus for him in Budget 2023 would be subsidy measures, as it would affect domestic inflation, which is forecasted to be 3.0% this year, down from 3.3% last year.

Suhaimi表示,他在 2023 年财政预算案中的另一个重点是补贴措施,因为这会影响国内通胀,预计今年国内通胀为 3.0%,低于去年的 3.3%。

“Budget 2023, which was tabled in October last year, hinted at subsidy rationalisation via a targeted mechanism against the current blanket system. It is indicated in a way when we look at allocation for subsidies and social assistance for this year, it was proposed to be cut by almost 30%.

“2023 年预算于去年 10 月提交,暗示通过针对当前一揽子系统的有针对性的机制进行补贴合理化。从某种意义上说,今年我们看补贴和社会救助的分配,它被提议削减近30%。

“The move towards targeted subsidy is perhaps taking shape already, with the revised electricity tariff for the first half of 2023, where there are hikes to MNCs (multinational corporations) and medium-to-high voltage users, but no change to domestic and low voltage users,” he said.

“定向补贴的举措可能已经初具规模,2023 年上半年的电价调整后,对跨国公司和中高压用户的电价有所上调,但对国内和低电压用户的电价没有变化电压用户,” 他说。