Asian equities to benefit from China's reopening and end of Fed's tightening cycle, says HSBC

HSBC Global Private Banking sees silver linings in the Asian market in 2023, led by peaking US Federal Reserve (Fed) interest rates, a softening US dollar, and China's improved recovery outlook.

HSBC Global Private Banking sees silver linings in the Asian market in 2023, led by peaking US Federal Reserve (Fed) interest rates, a softening US dollar, and China's improved recovery outlook.

汇丰全球私人银行业务认为 2023 年亚洲市场存在一线希望,这主要得益于美国联邦储备委员会 (Fed) 利率见顶、美元走软以及中国复苏前景改善。

According to Fan Cheuk Wan, the chief investment officer for Asia at HSBC Global Private Banking and Wealth, the resilient performance of the Asean economies in particular, which benefited from the global supply chain reorientation, stronger intra-regional trade and China's economic reopening, are also factors supportive of the Asian market.

汇丰环球私人银行及财富亚洲首席投资官Fan Cheuk Wan表示,得益于全球供应链的重新定位、更强劲的区域内贸易和中国经济的重新开放,东盟经济体的弹性表现尤其突出,也是支撑亚洲市场的因素。

“Looking ahead into 2023, a crucial inflection point for the markets is the upcoming end of the Fed's tightening cycle.

“展望 2023 年,市场的一个关键拐点是美联储紧缩周期即将结束。

“The US CPI (consumer price index) inflation has fallen short of consensus estimates for two consecutive months in October and November, and the Fed moderated the pace of interest rate hikes to 50 basis points (bps) in December 2022,” she said at the 2023 HSBC Global Private Banking and Wealth Investment Outlook virtual media briefing on 5th January.

“美国 CPI(消费者价格指数)通胀在 10 月和 11 月连续两个月低于普遍预期,美联储在 2022 年 12 月将加息步伐放缓至 50 个基点(bps),”她在1 月 5 日举行的 2023 年汇丰银行全球私人银行和财富投资展望虚拟媒体简报会。

She expects a final 50 bps rate hike in February 2023, before the Fed pauses the tightening.

她预计美联储将在 2023 年 2 月暂停紧缩之前最终加息 50 个基点。

“Given sticky core services inflation, we expect the Fed to keep the peak rate at 4.875% throughout 2023, before it cuts its policy rate by 25 bps in 2Q2024 (the second quarter of 2024) and 25 bps in 3Q2024, bringing the federal funds target range back down to 4.25-4.50% by the end of 2024,” said Fan.

“鉴于粘性核心服务通胀,我们预计美联储将在 2024 年第二季度(2024 年第二季度)将政策利率下调 25 个基点和 2024 年第三季度下调 25 个基点之前,将在整个 2023 年将最高利率保持在 4.875%,从而使联邦基金到 2024 年底,目标范围回落至 4.25-4.50%,” Fan说。

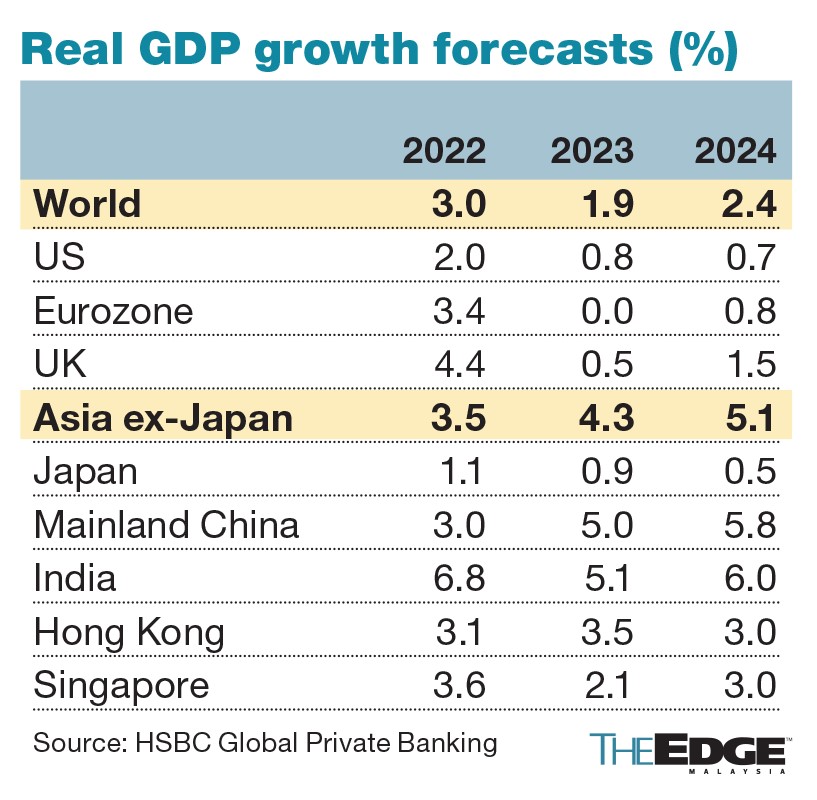

Fan added that Asia ex-Japan stands out as the only region projected to deliver gross domestic product growth acceleration to 4.3% in 2023, from 3.5% in 2022, driven by economic reopening in Mainland of China and Hong Kong Special Administrative Region, as well as solid growth in the Asean region.

Fan补充说,亚洲(日本除外)是唯一预计 2023 年国内生产总值增速将从 2022 年的 3.5% 加速至 4.3% 的地区,这主要得益于中国大陆和香港特别行政区经济的重新开放以及东盟地区稳健增长的推动。

Thailand and Indonesia outshine Malaysia

泰国和印度尼西亚胜过马来西亚

HSBC holds an overweight position on Asian ex-Japan equities. It is overweight on Mainland of China, Hong Kong Special Administrative Region, Indonesia and Thailand to reflect their positive growth outlook for 2023.

汇丰银行增持亚洲(日本除外)股票。它增持中国大陆、香港特别行政区、印度尼西亚和泰国,以反映它们对 2023 年的积极增长前景。

James Cheo, the chief investment officer for Southeast Asia at HSBC Global Private Banking and Wealth, said that Asean's resilient growth will continue to provide strong support for the Asian economy in 2023.

汇丰全球私人银行及财富东南亚首席投资官 James Cheo 表示,东盟的弹性增长将在 2023 年继续为亚洲经济提供强有力的支持。

“Within the Asean equity markets, we are overweight on Indonesia and Thailand, as they have witnessed the strongest earnings momentum in the region.

“在东盟股市中,我们增持印尼和泰国,因为它们见证了该地区最强劲的盈利势头。

“In Indonesia, robust domestic demand and elevated commodity prices continue to support strong investment and consumption growth. Thailand meanwhile will stand out as the only Asean economy projected to see growth acceleration to 3.8% in 2023 from 3.2% in 2022, thanks to continued benefits from the reviving tourism boom,” said Cheo.

“在印度尼西亚,强劲的国内需求和高涨的商品价格继续支持强劲的投资和消费增长。泰国与此同时将脱颖而出,成为唯一预计增长将从 2022 年的 3.2% 加速到 2023 年的 3.8% 的东盟经济体,这要归功于旅游业复苏繁荣带来的持续好处,” Cheo 说。

He added that Thailand is also a geared beneficiary of China's economic reopening, as it remains a top travel destination preferred by mainland Chinese tourists.

他补充说,泰国也是中国经济重新开放的受益者,因为它仍然是中国大陆游客首选的旅游目的地。

HSBC ‘neutral’ on Malaysian equities

汇丰银行对马来西亚股票“中立”

Despite 2022 having been a solid year for Malaysia's economy, recovering at a robust pace, HSBC keeps a "neutral" outlook on the Malaysian equity market, due to fewer positive catalysts to surprise investors on the upside, said Cheo.

Cheo 表示,尽管 2022 年对马来西亚经济来说是稳健的一年,复苏步伐强劲,但汇丰银行对马来西亚股市保持“中性”展望,因为令投资者感到意外的积极因素较少。

“We are neutral on Malaysian equities. Malaysia has a high level of reliance on exports, and a slowdown in global growth poses risks to the equity market.

“我们对大马股市持中立态度。马来西亚高度依赖出口,全球增长放缓对股市构成风险。

“Consensus earnings for Malaysia are expected to be healthy. The valuation of the equity market is trading below its historical average. Our preferred sectors for Malaysia will be on selected banks and consumer companies,” he said.

“马来西亚的普遍收益预计将是健康的。股票市场的估值低于历史平均水平。我们对马来西亚的首选行业将是选定的银行和消费公司,” 他说。

He added that Malaysia's diversified export base has been robust, although some commodity prices have cooled.

他补充说,尽管一些商品价格已经降温,但马来西亚多元化的出口基础一直很强劲。

“Looking into 2023, Malaysia's exports will likely slow down from the blistering pace in 2022. The good news is that Malaysia's domestic demand is likely to remain robust and supportive of overall growth,” said Cheo.

“展望 2023 年,马来西亚的出口可能会从 2022 年的迅猛步伐放缓。好消息是马来西亚的国内需求可能会保持强劲并支持整体增长,” Cheo 说。

He noted that a strong labour market, low unemployment rate and healthy wage growth in Malaysia would further support domestic consumption.

他指出,马来西亚强劲的劳动力市场、低失业率和健康的工资增长将进一步支持国内消费。

“Most of the high frequency indicators like retail sales have surpassed pre-pandemic levels, while the tourism sector should continue to improve in 2023. We expect Malaysia's economy to moderate and grow by 4% in 2023,” he said.

“零售额等大部分高频指标已超过大流行前水平,而旅游业应在 2023 年继续改善。我们预计马来西亚经济将放缓并在 2023 年增长 4%,” 他说。

He noted that Bank Negara Malaysia (BNM) will stay in the monetary tightening path a little longer to deal with core inflation that still remains high.

他指出,马来西亚中央银行(BNM)将在货币紧缩路径上停留更长的时间,以应对仍然居高不下的核心通胀。

“BNM's policy calibration will be very much dependent on the next few inflation readings. Therefore, we expect BNM to stay on its tightening path a little longer, delivering another 75 bps in hikes in the first half of 2023, thereafter taking a pause through 2024. With the peak of US dollar strength, we think that USD-MYR (the US dollar-to-ringgit exchange rate) could be at 4.35 by the end of 2023,” said Cheo.

“国行的政策校准将在很大程度上取决于接下来的几个通胀数据。因此,我们预计国行将在紧缩政策上停留更长的时间,在 2023 年上半年再加息 75 个基点,然后在 2024 年暂停。随着美元走强的顶峰,我们认为美元-到 2023 年底,马来西亚令吉(美元兑令吉汇率)可能达到 4.35,” Cheo 说。